Compliance shows customers that a business values security, integrity, and accountability.

In a marketplace filled with options, that commitment can be the difference between a fleeting interaction and a lasting relationship.

Ultimately, compliance is about earning trust, the most valuable asset in the digital era.

Trust plays a crucial role in businesses today since the digital economy is highly dynamic and competitive, and innovation and customer service are not the only successful strategies.

As fraudulent transactions, data breaches, and various financial crimes evolve, customers are now looking at companies to show integrity and responsibility in their involvement in the management and protection of data.

It is here that the issue of compliance, especially compliance and transaction monitoring, is important in the establishment and ongoing reinforcement of brand trust.

The Compliance in the Digital Age

The digital economy has changed the way business is carried out. Now, most of the financial interactions occur online as a result of online banking and e-commerce, fintech startups, and cryptocurrency exchanges.

Nonetheless, there are new threats to this convenience money laundering, identity theft, and terrorist financing, among others.

These risks are mitigated by compliance frameworks such as the regulations.

Compliance with international regulations that are enshrined in the rules and regulations of regulatory agencies like the FATF and the FinCEN shows that organizations adhere to ethical and transparent practices.

This not only saves them from the court consequences but also leaves the customers in no doubt that their dealings are safe and honest.

Why Trust Is the Secret of Online Success

Trust is the factor that determines the buying behavior and long-term loyalty in the age of endless opportunities to choose in terms of customers.

One breach of compliance or data can ruin years of goodwill. Reliability is an indicator that a business demonstrates a steady determination to comply with the regulations.

As an example, banks and fintechs are complying with the requirements to become reputable and accountable financial organizations.

Users will be more inclined to use a platform that explains the methods of protecting user data, avoiding financial crimes, and adhering to regulatory policies.

Compliance: The Building Blocks of Ethical Business Practices

Compliance is the ability of a company to comply with laws and regulations that are meant to stop money laundering and other associated crimes.

It entails enhanced due diligence, the ongoing monitoring of transactions, and reporting suspicious transactions in a timely manner.

Companies can achieve an environment that puts off illegal activity by implementing the practices as part of business operations.

Such transparency will facilitate closer relationships with the stakeholders, such as customers, investors, and regulators.

It demonstrates that the business is also more concerned about ethical issues rather than its short-term profits, which consequently increases its reputation within the market.

Transaction Monitoring and Its Contribution to Trust Building

One of the most important aspects of compliance is transaction monitoring.

It is tracking customers and analyzing their transactions in real time to identify abnormal trends that might point to fraud or illegal activities.

Good transaction monitoring systems not only protect an organization against financial and reputational losses but also assure the customer that their money is safe.

The users feel safer doing business with a company when they are aware that a given company is keen to monitor suspicious activities.

In addition, the current AI-based surveillance systems have been capable of detecting anomalies more swiftly and more efficiently than the old ones.

This proactive strategy reinforces customer confidence by demonstrating that the organization cares about the issues of safety and compliance at all points of the customer experience.

The Role of Compliance in Strengthening Brand Reputation

Brand reputation is created not only through marketing, but through deeds that are honest and responsible.

The ability to adopt compliance as an ethos sets businesses that adopt it apart as opposed to those that regard it as a compliance cost.

Transparency Aids Loyalty

When firms are well articulated about their compliance policies and ethical guidelines, the customer will consider them as a transparent and trustworthy company.

Scandal Prevision

Compliance reduces the chances of scandals and financial fraud, which may have a detrimental effect on the image of a brand.

Investor Confidence

With a proper compliance structure, investors and other partners will be attracted by the stability of long-term and ethical conduct.

Concisely, in the digital market, compliance will be a major factor in the management of reputation.

The Digital Age Business Case of Compliance

Compliance cannot be regarded as a cost but as a strategic investment. In addition to evading fines or penalties, it can access international markets, collaborations, and customer classes that require security and transparency.

Actually, companies that have an excellent compliance background tend to have better customer retention and expansion into the regulated market.

The other competitive advantage is that companies that demonstrate compliance and transaction monitoring are also competitive.

They are able to detect red flags early enough, mitigate the financial risk, and prove to both the regulators and the customers that they are responsible.

The proactive compliance strategy eventually results in the creation of greater brand equity and market credibility.

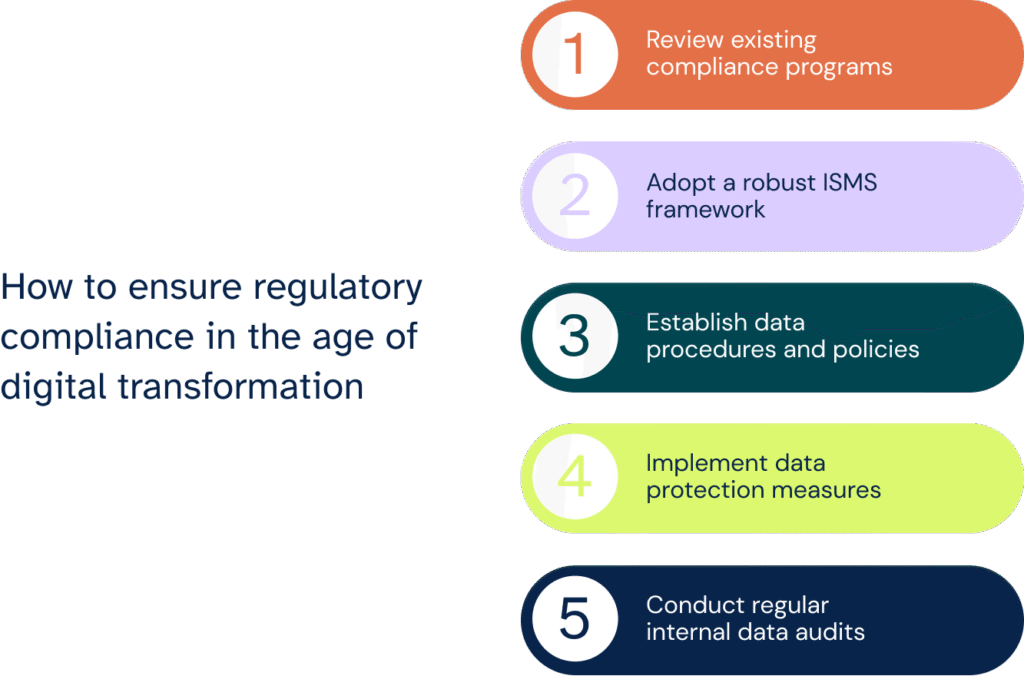

Preaching a Culture of Compliance and Trust

Compliance is not a single exercise, but it is a lifelong process that demands cultural fit in the organization.

All the employees, including executives and the customer service departments, have to be informed about the significance of adherence to regulations.

Internal audits, awareness programs, and training are useful in ensuring compliance is inculcated in the day-to-day decision-making.

Also, by relying on technology, including automated KYC checks and sophisticated transaction monitoring solutions, it will be easier to keep businesses in compliance without interfering with the process.

This has ethics, technology, and transparency, a culture that breeds trust as a byproduct.

Conclusion

Trust is money in the digital economy. Organizations that make investments in strong compliance models, specifically compliance and monitoring transactions, are not only complying with regulations, but they are establishing the cornerstones of long-term brand reputation and customer retention.

Compliance helps customers to understand that a business places importance on security, integrity, and accountability.

It is in a place where there are alternatives that promise can be the difference between a one-time affair and a long-term affair.

Finally, compliance is not merely a matter of meeting required legal standards, but also of gaining some form of trust, which is the greatest asset in the digital age.