Major parcel carriers UPS, FedEx, and DHL have announced a 5.9 percent rate increase for 2025, adding new hurdles for businesses trying to grow.

At the same time, global container port volume is projected to fall by 1 percent due to recent US trade policies, marking only the third recorded decline since 1979.

On top of these financial challenges, regulatory and geopolitical pressures continue to reshape how goods move across borders.

The International Maritime Organization has introduced stricter emissions standards, requiring shipping lines to modernize fleets and invest in greener technology.

Meanwhile, a persistent workforce shortage is disrupting operations across transportation, logistics, and customer service.

Even with these headwinds, the outlook offers reasons for optimism. E-commerce continues to expand worldwide, creating new pathways for companies that can adapt quickly.

The logistics sector is also showing signs of recovery after a prolonged slowdown.

For growing businesses, these shifts represent more than obstacles.

With the right strategies, shipping challenges can become opportunities to streamline operations, strengthen supply chains, and prepare for success in 2025 and beyond.

Sustainability and Environmental Pressures

Image Source: Reuters

Sustainability is the lifeblood of modern shipping trends. Maritime transport contributed about 3% of global CO2 emissions in 2018.

These emissions might surge up to 130% of 2008 levels by 2050 without proper intervention.

Growing businesses must adapt quickly to new regulations and technologies that reshape global shipping operations.

Alternative fuels and emission targets

The International Maritime Organization (IMO) wants to achieve net-zero greenhouse gas emissions from international shipping by or around 2050.

The strategy also includes key checkpoints to reduce emissions by at least 20% (with a target of 30%) by 2030 and at least 70% (with a target of 80%) by 2040 compared to 2008.

These targets need a radical alteration toward alternative fuels. Here are the main options:

- Ammonia: Delivers zero or near-zero carbon solutions on a tank-to-wake basis

- Hydrogen: Creates only water vapor as a byproduct when used in fuel cells

- Methanol: Results in lower emissions compared to traditional fuels

- Liquefied Natural Gas (LNG): Creates the lowest CO2 emissions among fossil fuels

- Biofuels: Works as “drop-in” alternatives that need minimal modifications to existing engines

Slow steaming and fuel efficiency

Slow steaming, reducing vessel cruising speed, works as an effective strategy to cut emissions.

Ships that reduce speed by 10% use 30% less engine power, which leads to much lower fuel consumption and emissions.

Ships using slow steaming now travel between 12 and 19 knots, sometimes half their normal 20 to 24 knots.

Results prove this method’s worth: a container ship moving at 21 knots instead of 24 knots cuts daily fuel consumption from 200 tons to about 125 tons.

Benefits go beyond environmental impact. The maritime industry saved about 1.8 million barrels of oil per day and $60 billion in fuel costs during 2023.

Ships also last longer due to reduced engine stress and maintenance needs.

Technology and Automation in Global Shipping

Image Source: Port Technology

AI and automation are transforming global shipping, driving efficiency, reducing costs, and reshaping how goods move across the world.

The market for AI in maritime shipping nearly tripled last year, reaching $4.13 billion.

These innovations are addressing long-standing industry challenges through practical, results-driven applications:

- AI for route optimization and planning: Advanced systems analyze vast amounts of historical and real-time data (including routes, traffic, weather conditions, and vessel performance) to determine the most efficient paths. Smarter routing reduces fuel consumption, improves safety, and allows ships to adapt quickly to changing sea conditions.

- Predictive maintenance and smart ports: AI-powered predictive maintenance detects potential equipment failures before they occur by analyzing sensor data and usage patterns. This prevents costly downtime and increases fleet reliability. Meanwhile, ports are evolving into fully automated hubs, such as Singapore’s Tuas Port, which uses digital twins, real-time vessel tracking, and dynamic berth allocation to forecast flows and prevent bottlenecks.

- Real-time tracking and data visibility: GPS, RFID, and cloud-based platforms give businesses full visibility into the movement of goods across the supply chain. Real-time tracking shifts logistics from reactive problem-solving to proactive control, improving on-time delivery, lowering detention fees, and strengthening customer trust.

- Digital documentation and paperless trade: Automation also extends to trade documents, where digital platforms replace manual processes. Paperless trade reduces delays, eliminates duplicate data entry, and enables faster customs clearance, saving both time and money while improving transparency between partners.

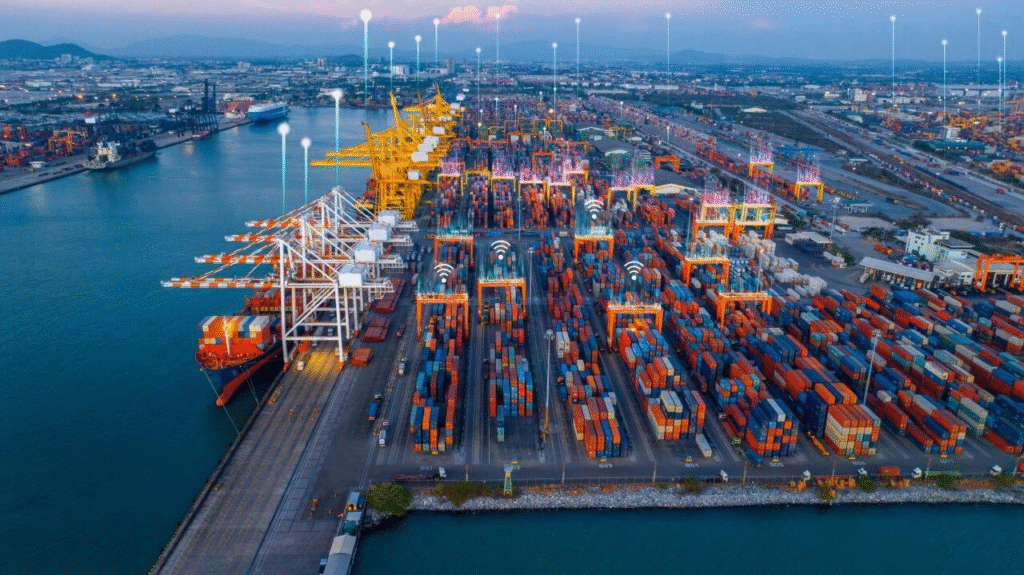

Geopolitical and Trade Policy Shifts

Image Source: Intueri Consulting

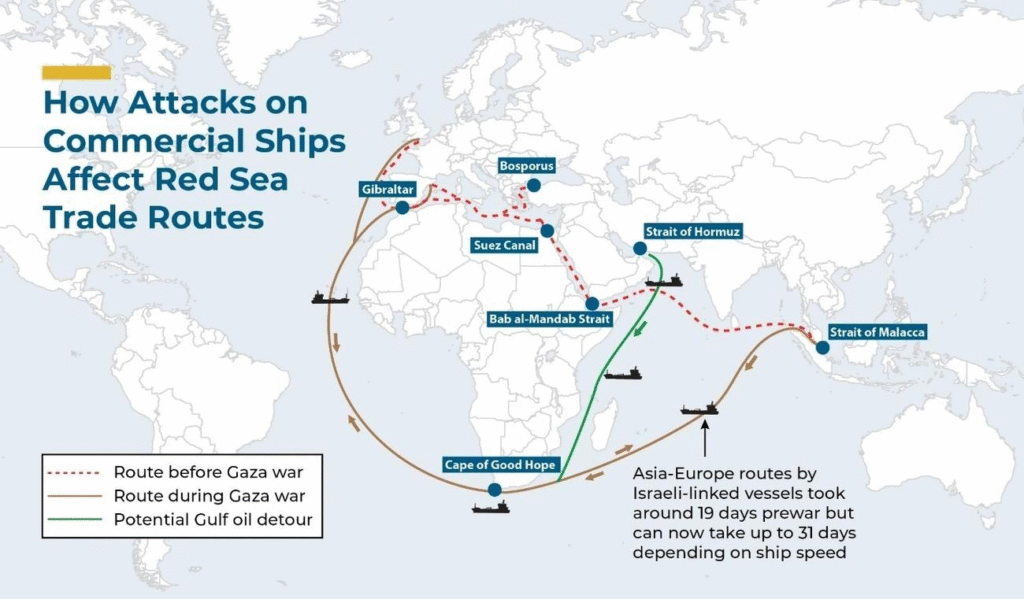

Global shipping trends face their biggest reshaping since the pandemic because of mounting geopolitical tensions.

Businesses must now tackle unprecedented challenges as they navigate international trade routes.

Red Sea and Suez Canal disruptions

The Suez Canal’s role in global trade has diminished dramatically. Ship crossings have plunged 66% at this vital waterway that handles 12% of worldwide trade.

Vessels now take the longer route around Africa’s Cape of Good Hope. This adds more than 10 days to their journey and cuts global container capacity by 9%.

The impact on shipping costs has been substantial. Rates from China to the US have doubled.

The situation looks even worse for Asia-to-Europe routes, where costs have jumped nearly five times.

Tariffs, sanctions, and trade realignments

Chinese goods entering America now face average tariffs exceeding 40%. This has transformed traditional trade patterns.

European trade has expanded significantly, with China-Europe imports and US-Europe exports each growing by $150-200 billion.

US imports from China have dropped 20% between 2018 and 2024 as friendshoring becomes more common.

Maritime shipping routes continue to adapt as sanctions against Iran, Russia, and Syria reshape the landscape.

Post-Brexit and US-China trade impacts

Brexit has changed the trading landscape between the EU and the UK. Trade volume has dropped by one-fifth, while 38% of road cargo at Schengen borders faces delays.

The situation grows more complex as US-China relations strain over rare earth minerals.

China’s dominance in this sector – controlling 70% of mining and 90% of processing – creates vulnerabilities for expanding businesses.

Strategic Adaptation for Growing Businesses

Businesses need to adapt their strategies to handle complex shipping challenges in 2025. The rise of stronger supply networks needs careful planning and implementation of several approaches.

Nearshoring and supply chain expansion

Recent surveys show that 54% of businesses choose nearshoring within North America as their strategy, while 66% prefer onshoring.

Companies don’t move all operations back home. They broaden their supply chains to protect themselves from international shipping problems.

Working with tech-savvy logistics providers

Growing businesses gain great advantages by working with technology-focused logistics startups.

These partners offer more flexible fulfillment options than traditional companies, including reliable solutions such as FCL shipping for larger cargo needs.

Providers like Ship4wd combine digital innovation with global expertise, making it easier for businesses to manage freight efficiently and with greater visibility.

Business owners should carefully evaluate a tech partner’s funding stability, track record, and ability to integrate multiple services into one system.

Making use of digital documents and paperless trade

Digital trade documents can speed up exports by 44% and lower costs by 31%. Paperless systems let companies reuse data at different supply chain points and eliminate duplicate manual entries.

Setting up these systems needs focus on compatibility between trade partners through global standards and tech-neutral laws.

Conclusion

The global shipping landscape in 2025 is shaped by rising costs, shifting trade routes, and mounting environmental pressures.

Yet within these challenges lies the chance for businesses to build resilience and position themselves for growth.

Companies that embrace sustainability, leverage advanced technology, and form strong partnerships with innovative logistics providers will not only weather current disruptions but also create lasting competitive advantages.

Success will belong to businesses that see shipping not as a barrier but as a pathway to smarter operations and stronger global reach.

By adapting early and investing in flexible, future-ready strategies, growing companies can turn uncertainty into opportunity and secure their place in the evolving world of international trade.