A good 78% of respondents claimed that their organization is utilizing AI in at least some business processes (up from 72% in 2024), according to McKinsey’s 2025 State of AI report.

This pattern is also evident in the finance sector, where plenty of companies have begun using automation powered by AI.

However, at large, most deployments are still limited to isolated use cases like customer chatbots or fraud detection.

The next step forward, as it turns out, is the rise of custom AI Agents designed for end-to-end finance operations (FinOps).

These agents can connect across systems, learn from confidential financial data, and make decisions on their own in real time, contrary to how single-point AI solutions work.

For financial executives, this transition includes moving from scattered automation to coordinated processes that boost productivity, lower risk, and reinforce compliance.

This blog post will dive deeper and explore how AI has transformed FinOps and how AI Agents are now driving these transformations.

What’s Already Happening with AI in Finance?

After almost a decade of hype, AI has also gained traction across several use cases within the finance industry.

This goes beyond basic automation and back-office operations, spanning banking services and other internal as well as customer-facing FinOps.

Let us explore some of the areas where AI has worked wonders in banking and financial service delivery.

→ Customer Support: Many banks and financial institutions use AI in banking to respond to customer queries by integrating GPT-like chatbots and virtual assistants (VAs). These assistants answer questions, guide users through the website/app, submit and process loan applications, and provide status information.

→ Robo-Advisors and Wealth Management Consultants: In the investment-related service sector, machine learning in finance has enabled companies to build robo-advisors that help people manage their portfolios. This market is all set to reach US$2.06 tn by the end of 2025.

→ Algorithmic Trading: The utilization of algorithmic, AI-powered risk assessment models in banking has helped organizations empower their trading operations. In the US alone, these algorithmic models have executed over 60-70% of equity trades (Artificial Intelligence in Financial Services Report, World Economic Forum).

→ Predictive Management: Besides modeling investment risks, machine learning in finance is also utilized for credit scoring to guide loan approvals. Herein, ML models are used to examine user profiles for transaction histories, incomes, and other financial patterns. This analysis helps banks and organizations to determine ‘risk thresholds,’ improving approval decisions.

As seen above, AI in finance has largely delivered on two areas:

- Service automation

- Predictive decision-making

And this has been enough for a considerable period of time, until it wasn’t.

Limitations of Current AI Adoption in Finance

While AI has delivered tangible benefits in the finance industry, most pilots and current deployments failed to garner consumer and, hence, stakeholder trust.

Here is a peek into why this happened:

Fragmented AI Ecosystem

The orchestration is lacking. Financial institutions still use point solutions for distinct tasks like customer support, fraud detection, compliance checks, etc.

When integrating AI into financial operations, it can be challenging to attain end-to-end visibility because these solutions often operate in isolation.

Static AI Models

There is no to little adaptability to new data or happenings. Traditional machine learning in finance models relies on historical training data and not real-time streams.

Consequently, they fail to accommodate the fast-changing nature of data in this industry, whether it is new fraud patterns or sudden market volatility. This weakens the effectiveness of AI-driven predictive risk management.

Limited Customization for Company-Specific FinOps

Many banks and financial institutions integrate pre-built, off-the-shelf AI solutions that rarely perform on their proprietary data, internal workflows, and audit frameworks.

Additionally, these solutions fail to integrate other existing systems such as ERPs, email automation tools, payment platforms, etc.

The above limitations have driven organizations’ attention toward custom AI Agents in finance.

What are Custom AI Agents in Finance and Why They Matter?

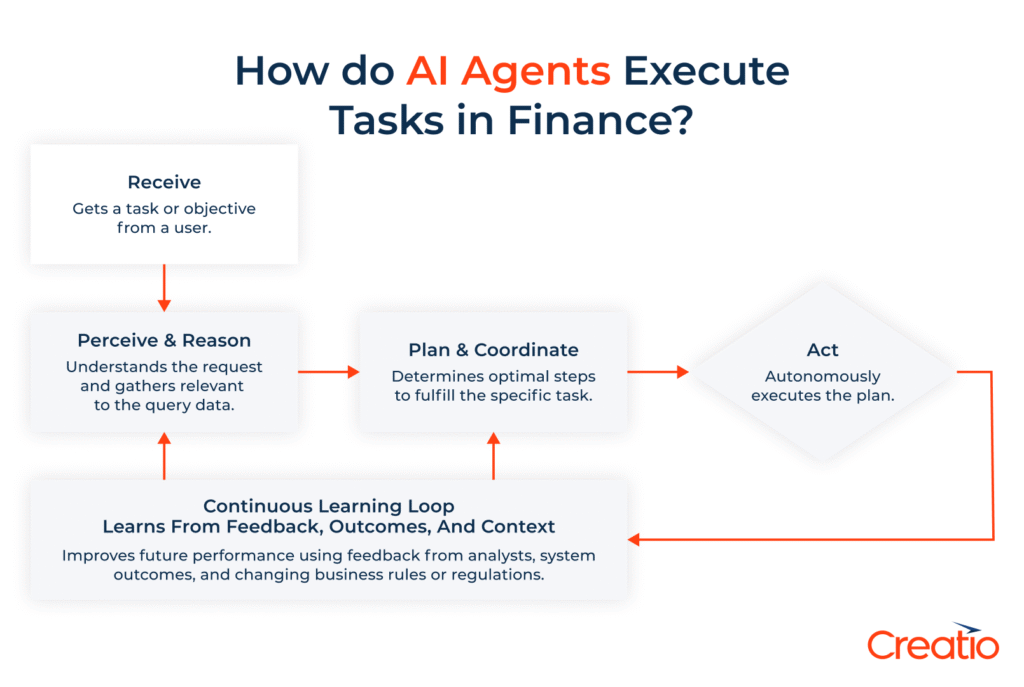

Custom AI Agents in finance are autonomous, self-learning, and task-oriented systems designed to work within an organization’s unique financial environment.

Unlike rule-based process automation, AI Agents are driven by context, trained on streaming proprietary data, and aligned with business logic.

This enables finance AI Agents to deliver the following benefits:

→ Context-Guided Decision-Making: Going beyond if X then Y programming to interpret financial data within the analysis scope.

→ Spontaneous Execution: Adapting to sudden market shifts, changing demand, and liquidity risks.

→ Enhanced Interoperability: Enabling seamless, secure connections with ERPs, treasury, audit, and payment systems.

→ Continuous Learning: Evolving over time without significant re-training or tuning.

Strategic Implementation of AI Agents in Finance

Vision: Finance AI Agents as Intelligent Co-Pilots across Finance Teams.

Custom AI Agents in finance are designed to act as coworkers, working alongside finance teams, including top-level employees such as CFOs, treasurers, and financial arbitrators, to auditors and risk managers.

So, instead of replacing humans, these agents extend financial teams with continuous monitoring and adaptive intelligence.

They can also draw insights from your company knowledge base to make more informed and consistent decisions.

Consequently, integrating AI Agents allows organizations to move through three distinct stages of AI maturity:

Automation – AI Agents handle typical processes like invoicing, reconciliations, and compliance checks. They can also integrate with revenue tracking software to monitor income streams in real time, ensuring accurate financial records and faster reporting. Unlike RPA, they use machine learning in finance to improve accuracy and efficiency.

Implementing RAG evaluation also enables agents to retrieve relevant data and reason over it effectively, improving decision-making in complex financial workflows.

Autonomy – With AI-powered predictive insights in finance, AI Agents anticipate risks and act proactively. They flag liquidity gaps and market anomalies in real-time.

Orchestration – At AI maturity, AI Agents connect and orchestrate treasury, fraud monitoring, and credit assessments holistically. This aligns decisions with strategy, maximizing investment ROI.

Mapping AI Agents to the FinOps Lifecycle

As FinOps grows increasingly complex, custom AI Agents in finance are evolving toward a more complicated, integrated role across the entire value chain.

Rather than working in silos, they offer intelligence into every stage of the lifecycle, from treasury to compliance.

Here are some typical roles and how AI Agents in finance take them over.

| Function | Agent Role |

| Treasury & Cash Flow | Monitor liquidity, forecast positions, flag anomalies |

| Risk Management | Identify threats, simulate risk scenarios, recommend mitigations |

| Accounts Payable/Receivable | Predict delays, flag duplicate invoices, automate reconciliations |

| Fraud Detection | Monitor transactions in real-time, detect behavioral anomalies |

| Audit & Compliance | Check policy adherence, surface inconsistencies, generate audit trails |

Technical Deep Dive: Designing a Finance AI Agent

Building custom AI Agents in finance requires a modular design that balances intelligence, security, and integration.

Here is how you can do it:

- Start by understanding how data, AI/ML models, and business logic will come together to drive intelligent decisions.

- Gather and integrate the right data from ERPs, ledgers, and banking systems.

- Once your data is set, build the intelligence layer. Use a tailored mix of machine learning, reinforcement learning, and large language models to detect patterns and teach the agent how to ‘think.’

- Encode the business logic. Revisit and digitize your organization’s credit policies, decide risk limits, and compliance (with GDPR, CCPA, SOC 2, etc) guidelines.

- Design interfaces that trigger APIs, generate alerts, or automate reporting.

- Choose your deployment model. Go for cloud-native deployments (on platforms like Azure, AWS, and Google Cloud) for scalability or on-premises for tighter control over sensitive financial data.

Accordingly, the core components become:

- Data Ingestion Layer

- ML/LLM Engine

- Business Logic Modules

- Action Interfaces

- Integration Touchpoints

How to Maximize AI Agent Development ROI

To realize full AI Agent ROI, organizations must think beyond development and prioritize deep integration within their organization.

This includes integrating AI Agents at the very core, among the people, and in all processes.

Training & Fine-Tuning AI Agents with Financial Data

The effectiveness of integrating AI Agents in financial services depends heavily on the quality and relevance of the data it learns from, as AI still follows the ‘garbage in, garbage out’ philosophy.

If your finance AI Agents are trained on your data (fraud records, account histories, etc), they will deliver more accurate risk assessments and predictive insights.

Continue the process periodically to ensure your agents can adapt to ongoing user behaviors and threat perceptions, positioning them to add measurable value over time.

Risk, Compliance & Governance Considerations

Despite being autonomous, actual value will only come when finance AI Agents operate within clear governance frameworks and determined safeguards set by humans.

This remains imperative to meet regulatory requirements and build trust.

C-Suite Perspectives

The adoption of AI Agents has become a hot boardroom discussion in all organizations and across all industries, including finance.

While Agentic AI promises 100% autonomy and intelligence, CTOs and CFOs are grappling with the challenge of balancing innovation with risk: seeing AI in banking not just as automation, but as a catalyst for competitive advantage.

The idea, as per many reputed leaders like Microsoft’s Satya Nadella and JPMorgan Chase’s Jamie Dimon, is to treat AI as an Agent and not as a service, applying it to a broader range of workflows and use cases.

Final Consensus: AI Agents in finance are no longer optional pilots, they’re digital coworkers that must be scaled strategically.

What’s Next

This blog has shown how AI Agents in finance are helping organizations move beyond task-specific automation toward full workflow orchestration.

These agents are paving the way for greater integration throughout the financial ecosystem by providing predictive insights and enabling real-time fraud detection with AI.

Finance AI Agents will progress from copilots to autonomous decision-makers as AI in banking and financial services continues to evolve, providing quantifiable value throughout the FinOps lifecycle.

The majority of deployments, however, currently follow a human-in-the-loop governance model, which guarantees that finance AI Agents behave in accordance with established safeguards while executives maintain final control.

The direction is obvious: financial institutions that adopt this change as soon as possible will be in the best position to benefit from the strategic advantage and resilience that artificial intelligence in finance can offer.