By Teja Kurane, a research analyst with expertise in global trade and finance. With a keen interest in risk management and international commerce, Teja provides insights on trade finance strategies that enhance efficiency, safeguard transactions, and support sustainable growth in the global market.

Disclaimer

This article is for informational and educational purposes only and does not constitute financial or legal advice. Businesses should consult with licensed financial advisors, banks, or trade finance specialists before making decisions regarding cross-border trade and financial instruments.

Trade finance encompasses a broad set of financial products and services that enable safer, more efficient cross-border transactions.

By bridging the gap between exporters and importers, trade finance mitigates risks such as non-payment, political instability, and supply chain disruptions.

According to the World Trade Organization (WTO), over 80–90% of global trade relies on some form of trade finance.

This reliance highlights the importance of financial mechanisms for sustaining the flow of international commerce.

To achieve this, businesses and financial institutions rely on a set of core trade finance instruments:

- Letters of Credit (LCs) – guarantee the seller’s payment once the agreed contractual terms are fulfilled.

- Trade Credit Insurance – protects exporters against buyer default and political risks such as instability or regulatory shifts.

- Documentary Collections – link payment to shipping and delivery documentation, ensuring goods are verified before funds are released.

- Factoring – allows companies to convert accounts receivable into immediate working capital, improving liquidity.

Together, these tools provide the security and transparency necessary to build trust in cross-border trade.

Yet despite their importance, many businesses (especially small and medium-sized enterprises) remain unaware of how trade finance works or how it can shield them from costly risks.

That’s why understanding these instruments can mean the difference between missed opportunities and lasting success in global markets.

Mitigating Major Risks in Global Trade

1. Risk of Non-Payment

One of the greatest challenges in international trade is the risk that buyers may default on payments. Distance, different legal systems, and enforcement difficulties make this risk particularly high.

Letters of Credit, issued by trusted banks, act as guarantees: payment is made to the seller once contractual terms are fulfilled. The International Chamber of Commerce (ICC) notes that LCs account for nearly $2 trillion in trade transactions annually.

2. Political and Economic Risks

Global trade is highly exposed to political instability, sudden regulatory shifts, and economic downturns.

Trade Credit Insurance offers exporters protection against such uncertainties, covering risks ranging from political upheaval to insolvency of overseas buyers.

For instance, the OECD highlights that such insurance helps exporters access new, riskier markets by reducing potential losses.

3. Currency Fluctuations

Currency volatility can erode margins in cross-border deals. Exchange rate shifts during a contract’s lifecycle may lead to significant financial losses.

To address this, companies often use forward contracts and hedging instruments, locking in exchange rates for future transactions.

Banks and financial institutions provide foreign exchange risk advisory services, which are especially valuable for SMEs unfamiliar with volatile FX markets.

4. Supply Chain Risks

Strikes, natural disasters, or transport delays can severely disrupt supply chains.

- Documentary Collections help mitigate risk by ensuring payment is released only after goods are received and verified.

- Factoring allows exporters to convert receivables into immediate cash, providing liquidity to withstand disruptions.

According to the OECD’s report, factoring has become a lifeline for SMEs during supply chain crises, especially following the COVID-19 pandemic.

Enhancing Global Trade Efficiency

Building Trust Across Borders

Trust is essential in trade between partners separated by geography, culture, and legal frameworks. Trade finance instruments provide the monetary security both sides need, fostering confidence and making international trade more attractive.

Empowering Small and Medium-Sized Enterprises (SMEs)

SMEs often face barriers to accessing credit due to a lack of collateral. Trade finance provides alternatives:

- Letters of Credit offer security to both buyers and sellers.

- Factoring and invoice discounting improve liquidity, allowing SMEs to compete globally.

The Asian Development Bank (ADB) reports that the global trade finance gap, disproportionately affecting SMEs, stood at $2.5 trillion in 2022, underscoring the importance of accessible financing.

Improving Cash Flow and Working Capital

Cash flow is the lifeline of any trading business. Tools like supply chain finance and invoice discounting enable quicker access to funds, shortening the working capital cycle. This allows companies to reinvest in growth, expand into new markets, and upgrade infrastructure.

To streamline operations further, integrating purchase order management software can help businesses track and manage orders efficiently, ensuring smoother cash flow.

The Evolving Trade Finance Market

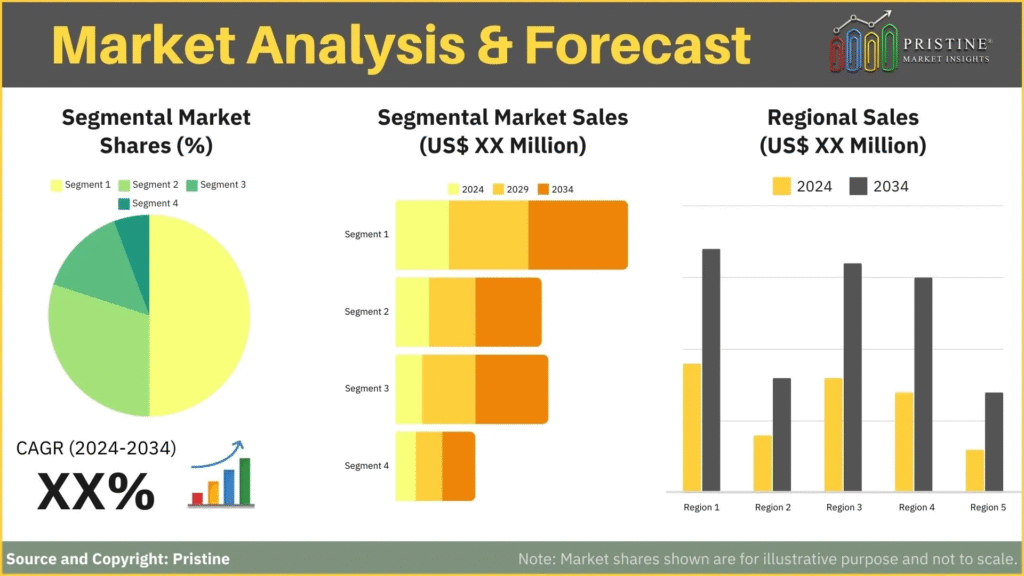

The global trade finance market plays a key role in enabling cross-border transactions by providing liquidity and risk-mitigation solutions.

Banks, financial institutions, and fintech firms supply financial products that close the gap between importers and exporters, ensuring smoother flows of goods, services, and capital.

Digitalization and blockchain technologies are transforming the industry by increasing transparency, reducing fraud, and improving efficiency.

According to the Bank for International Settlements (BIS), digitized trade finance processes could reduce global transaction costs by up to 30% in the coming years.

Industry research further underscores the importance of these tools.

Pristine Market Insights (2023) highlights that trade finance is essential for reducing international trade risks such as supply chain interruptions, political unrest, currency fluctuations, and nonpayment.

Financial services, including factoring, trade credit insurance, and letters of credit, not only safeguard transactions but also improve working capital, foster trust, and expand SMEs’ access to loans.

As the global economy becomes more interconnected, the trade finance market will remain a critical enabler of international commerce and economic growth.

Conclusion

Trade finance is a critical enabler of global commerce. By mitigating risks ranging from non-payment to currency fluctuations, and by improving liquidity and trust, it makes cross-border trade more secure and efficient.

As the global economy becomes increasingly interconnected, the role of trade finance will continue to expand, particularly in supporting SMEs and driving sustainable economic growth.

References

- World Trade Organization (WTO), Trade Finance and SMEs: Bridging the Gaps, 2023

- International Chamber of Commerce (ICC), Trade Register Summary Report: Global risks in trade finance, 2023

- OECD, Global Insurance Market Trends, 2024

- OECD, Financing SMEs and Entrepreneurs: An OECD Scoreboard, 2020

- Asian Development Bank (ADB), Trade Finance Gaps, Growth, and Jobs Survey, 2022

- Bank for International Settlements (BIS), Digitalisation of finance, 2023

- Pristine Market Insights, Trade Finance Market Report, 2025