For SaaS companies that serve financial institutions, digital marketplaces, or other B2B networks, Know Your Business (KYB) verification is no longer optional, but a basic requirement.

The main goal of a strong KYB process is to make sure that every company you onboard is genuine and legitimate.

It helps prevent financial crimes such as fraud, money laundering, and the creation of shell companies.

By verifying business information, your platform can stay compliant with anti-money laundering rules and reduce the risk of working with unsafe or illegal entities.

For developers and IT teams, the challenge is to integrate KYB verification into existing systems in a smooth and efficient way, without hurting the user experience or slowing down projects.

In this guide, we’ll explain both the technical and practical steps to build a solid KYB solution for modern SaaS platforms, where automation, integration, and scalability are key to long-term success.

What KYB Means and Why It Matters

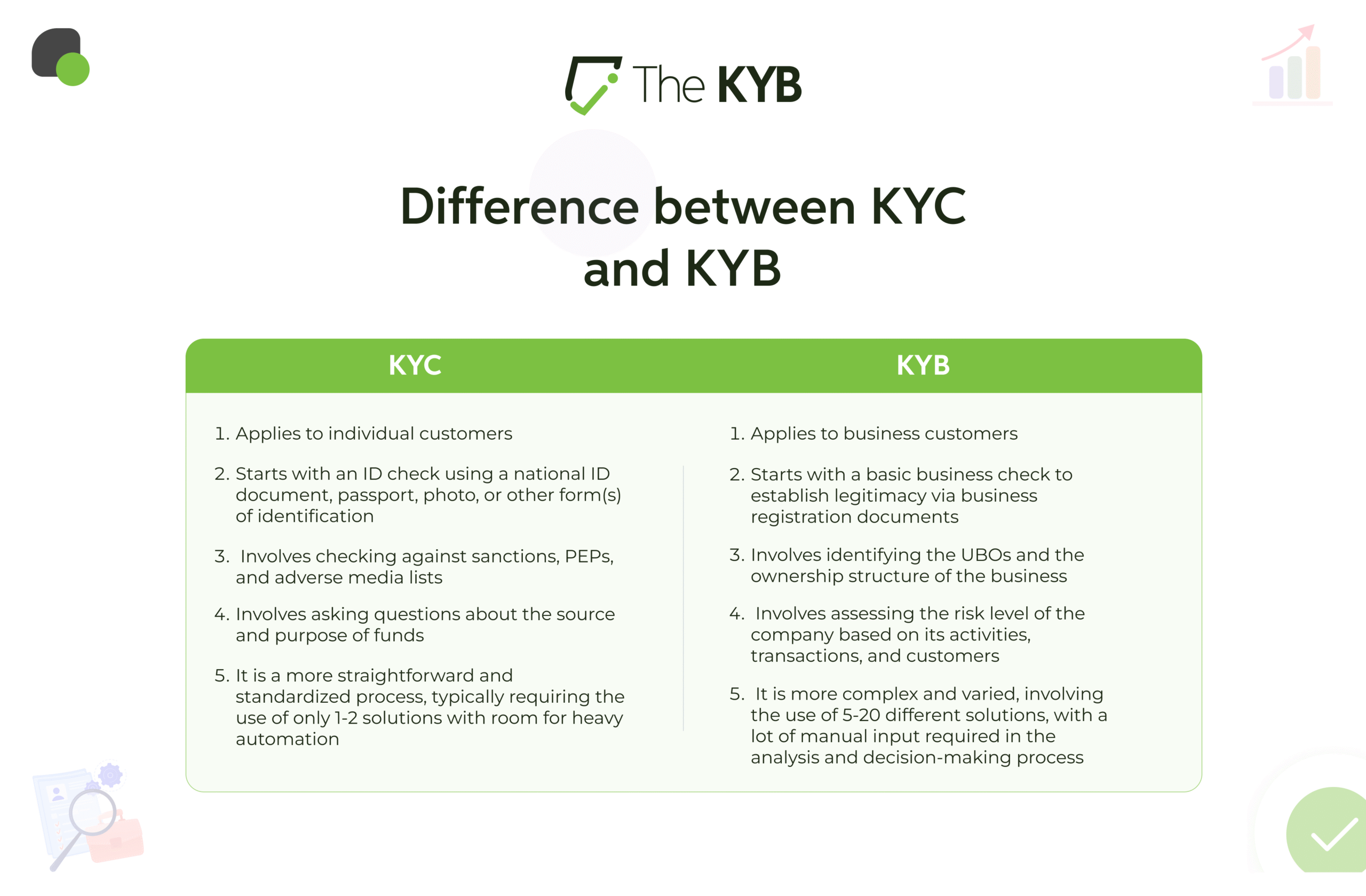

Know Your Business (KYB) is the corporate version of Know Your Customer (KYC).

Its main goal is to confirm the legitimacy and authenticity of an organization before doing business with it.

In simple terms, KYB helps verify that a company is real, properly registered, and operating within the law.

The process involves collecting key business information (such as registration numbers, legal structure, directors, and beneficial owners) and confirming that this data is accurate and up to date.

From a developer’s point of view, KYB means building data pipelines that connect to trusted information sources like government registries, company databases, and sanctions lists.

These systems automatically check and cross-verify the information provided by the company.

A well-designed KYB solution doesn’t stop at onboarding. It also monitors for changes over time, ensuring that compliance is maintained throughout the entire lifecycle of the customer or partner.

The Importance of KYB Verification in SaaS Applications

For SaaS platforms that manage partner networks, vendor onboarding, or enterprise clients, KYB verification is key to reducing risk and staying compliant with regulations.

If a company onboards a high-risk or fraudulent business without proper verification, it can face serious reputational damage, regulatory penalties, and financial loss.

By implementing a strong KYB process, developers can help create trust-based ecosystems that protect both the platform and its users.

Beyond compliance, KYB adds a layer of credibility and transparency that strengthens business relationships.

From a project management perspective, KYB can also be introduced as an iterative part of development cycles.

For example, compliance checks can be built into sprint deliverables or automated testing pipelines, ensuring that product updates continue to meet regulatory standards as the platform evolves.

In environments that rely on IT Service Management (ITSM) or Project Portfolio Management (PPM) frameworks, KYB can be embedded as automated validation steps.

These checks might run before starting a new project, assigning a vendor, or processing financial transactions.

Ultimately, KYB is more than just a compliance requirement. It’s a smart, integrated layer of operational governance that supports responsible growth and long-term trust across the SaaS ecosystem.

How to Build an End-to-End KYB Verification Process

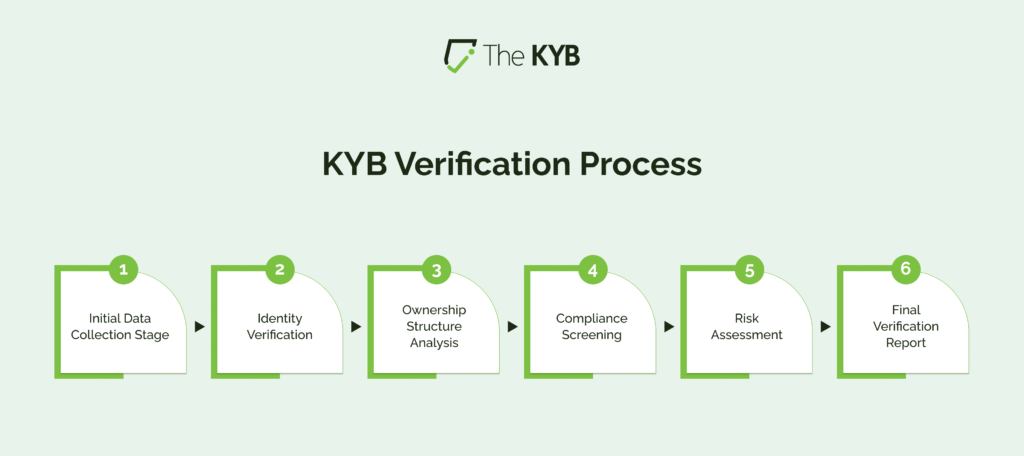

A complete KYB process brings together several business workflows that work in sequence to verify and monitor organizations.

Typically, an end-to-end KYB framework includes four main stages:

- Data Onboarding – Collecting company information such as registration details, ownership structure, and business identifiers.

- Data Verification – Validating the collected information against government databases, sanctions lists, and trusted third-party sources.

- Data Analysis – Assessing the accuracy and risk profile of the organization using predefined compliance and scoring logic.

- Data Reporting – Presenting verification results through dashboards or reports for compliance and audit purposes.

From a developer’s perspective, this can be achieved using a modular architecture or microservices that communicate through secure APIs.

For example:

- The onboarding module collects company data.

- The verification engine connects to external data repositories.

- The compliance logic runs automated risk scoring and decision rules.

- The reporting dashboard displays results in real time for compliance teams.

By following Agile project management principles, these components can be developed incrementally.

Each sprint can focus on a specific capability, such as building an API to retrieve company registry data in one sprint, and adding beneficial ownership checks in the next.

An Agile-driven KYB solution allows teams to adapt quickly to new regulations and data sources without rebuilding the entire system.

This flexibility makes the platform easier to maintain and scale while keeping compliance requirements up to date.

The Role of KYB Automation

Every scalable KYB solution depends on automation. Manual checks are slow, inconsistent, and nearly impossible to manage at scale, especially for SaaS platforms that handle hundreds or thousands of verification requests each day.

By automating KYB processes, companies can achieve faster verification speeds, fewer human errors, and greater operational efficiency.

An automated KYB system can handle tasks such as periodic re-checks of verified entities, real-time alerts for high-risk profiles, and workflow triggers when changes occur in company ownership or compliance status.

For example, when a business updates its directors or beneficial owners, the system can automatically flag and re-verify the entity to maintain compliance.

Modern KYB platforms often use a combination of machine learning, data orchestration, and API-driven integrations to create a continuous verification cycle, sometimes called rolling re-verification.

This ensures that data remains accurate and compliance stays active over time, rather than being a one-time event at onboarding.

From an Agile project management perspective, embedding automation into KYB processes improves visibility and accountability across teams.

Developers can create automation templates as user stories, track them within sprint boards, and manage them through issue-tracking tools.

This approach allows teams to iterate quickly, ensure consistent compliance, and keep development cycles efficient and transparent.

Integrating KYB Verification into SaaS Architecture

Integrating KYB verification into a SaaS platform requires careful design decisions that balance security, scalability, and user experience.

Each architectural layer (from APIs to orchestration systems) must support compliance while keeping the integration seamless for both developers and end users.

When developing APIs, it’s important to define endpoints that can securely exchange business data between systems and third-party providers.

These exchanges should use encrypted communication channels and comply with relevant data privacy and security standards, ensuring that sensitive information remains protected throughout the process.

KYB modules can be deployed efficiently through containerized runtimes such as Docker or Kubernetes. This approach allows teams to scale verification services dynamically and manage deployments through orchestration platforms in the cloud.

Integration doesn’t need to create friction for users.

By embedding KYB checks within existing project or workflow management systems, compliance can be monitored and enforced automatically, without requiring users to switch between multiple interfaces.

For platforms already using Agile, IT Service Management (ITSM), or Project Portfolio Management (PPM) frameworks, KYB verification can be added directly to workflow automation.

For example, during a new client or vendor onboarding process, the system can automatically run a KYB check before final approval.

Smaller organizations can also use KYB as a gatekeeper step before new vendor contracts, procurement activities, or financial transactions proceed.

Scaling KYB Compliance for SaaS Platforms

As regulatory requirements continue to evolve, SaaS companies need flexible KYB solutions that can quickly adapt to new compliance standards and data sources.

Developers must ensure that their systems can easily connect to new jurisdictional databases, integrate with updated data providers, and adjust to regulatory changes as they are introduced.

For IT professionals managing compliance infrastructure, monitoring dashboards and audit trails play a critical role.

These tools help track every step of the KYB verification process, providing visibility into how data is collected, validated, and reported.

A centralized reporting layer can then give compliance and security teams a real-time view of verification statuses, potential risks, and system performance.

By combining automation, flexible integration, and centralized oversight, SaaS teams can achieve end-to-end KYB process management that scales with business growth.

This approach keeps compliance embedded at the core of every transaction, ensuring that as the platform expands, it remains both secure and regulatory-ready.

SaaS and the Future of KYB Services

As digital ecosystems expand and cross-border collaborations become the norm, the importance of KYB services in SaaS development will continue to grow.

In the near future, AI and machine learning will play a key role in predicting business risks, identifying suspicious activity, and automating verification decisions, reducing the need for manual review and speeding up the entire process.

KYB as a Service (KYBaaS) is emerging as a powerful model for both agile startups and enterprise organizations.

By integrating KYB checks across the enterprise (within ITSM platforms, internal systems, and automated workflows), companies can achieve greater transparency, trust, customer re-verification and regulatory readiness at every operational level.

Ultimately, the future of KYB lies at the intersection of technology and compliance.

As thought leaders like Hansen have noted, the most successful businesses will be those that innovate responsibly, using technology to streamline compliance while maintaining integrity and trust as core business values.

Conclusion

When developers design KYB processes with automation, modular architecture, and secure APIs, they enable platforms to operate with confidence across industries and jurisdictions.

For project managers and IT leaders, embedding KYB into Agile workflows and enterprise systems ensures that compliance remains a continuous, proactive process rather than a reactive obligation.

As regulations evolve, a flexible KYB framework empowers organizations to adapt quickly while maintaining transparency and operational integrity.

In the end, the success of any SaaS product depends on the trust it earns. A well-integrated KYB system not only protects the platform from risk but also becomes a competitive advantage, helping businesses scale responsibly and thrive in an increasingly regulated digital world.