Do you ever look at your bank statement and wonder where all your money went? You’re not alone. Most Americans are currently managing between 4 and 6 active subscriptions, and many have forgotten about at least one that they’re still paying for.

That $9.99 here and $14.99 there adds up quickly, siphoning hundreds of dollars a year from accounts without people even realizing it.

Managing subscriptions shouldn’t feel like detective work. Yet for millions, tracking down every recurring charge feels overwhelming.

The good news? Apps for subscription management and cancellation have transformed this tedious task into something you can handle in minutes.

Why Subscriptions Spiral Out of Control

Subscriptions sneak up on us. We register for a streaming service when it’s free to try, we forget to cancel subscription app, and suddenly we’re paying subscriptions to three video platforms that collect dust.

Toss in gym memberships, meal kits, software tools, and music services, and the chaos is exponential.

It’s a worse problem, because companies make it easy to sign up and hard to cancel. They bury cancellation buttons on deep settings pages or ask for a phone call during business hours.

This friction is what gets people to keep paying for services they don’t really want or need.

But that’s where apps and services for managing and cancelling subscriptions come in to even the score.

Top Tools That Actually Work

Several standout platforms have earned strong reputations for helping people regain control of their recurring expenses.

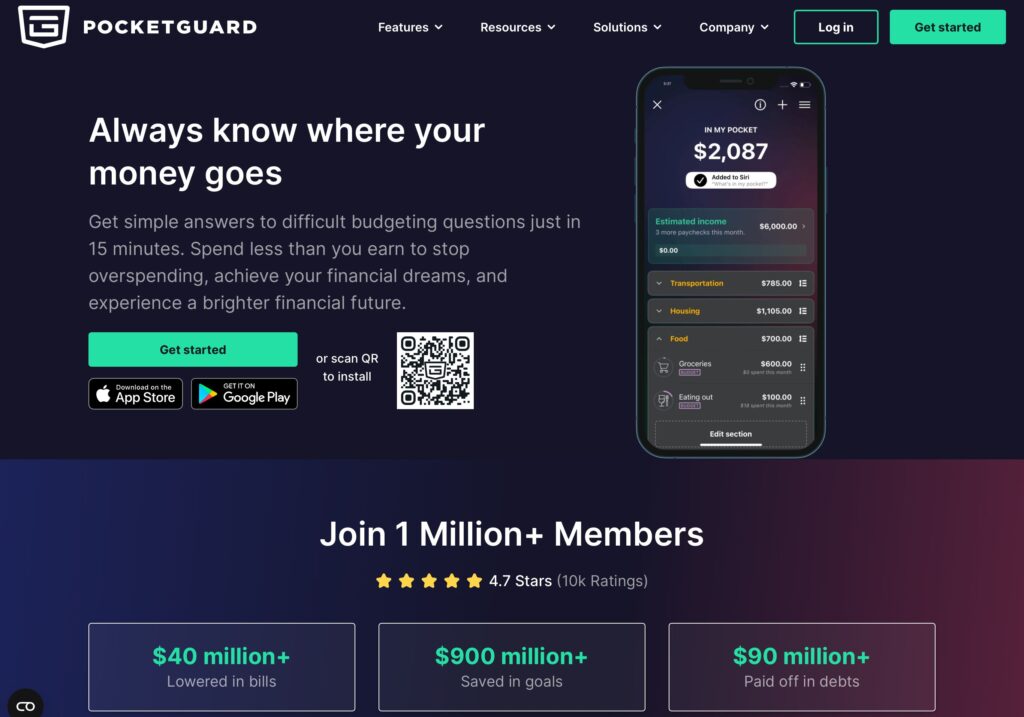

1. PocketGuard

PocketGuard ranks among the most comprehensive options available. Beyond finding subscriptions, it tracks your overall spending and shows how much disposable income remains after bills.

The cancel subscription app feature streamlines the entire process, letting users terminate unwanted services without leaving the platform.

It also sends alerts before free trials convert to paid subscriptions, preventing unwanted charges before they happen.

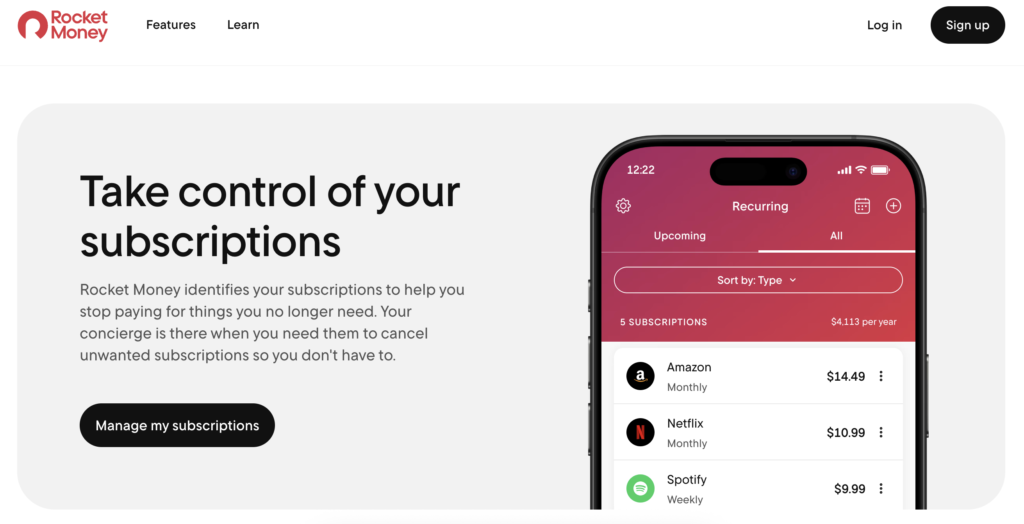

2. Rocket Money

Truebill (now Rocket Money) takes an aggressive approach to cutting costs. The app not only identifies subscriptions but negotiates lower bills on services like cable and internet.

Users can cancel through the app, and customer service representatives will even handle the cancellation calls for you.

According to MarketWatch, many users save over $500 annually after using the platform for just a few months.

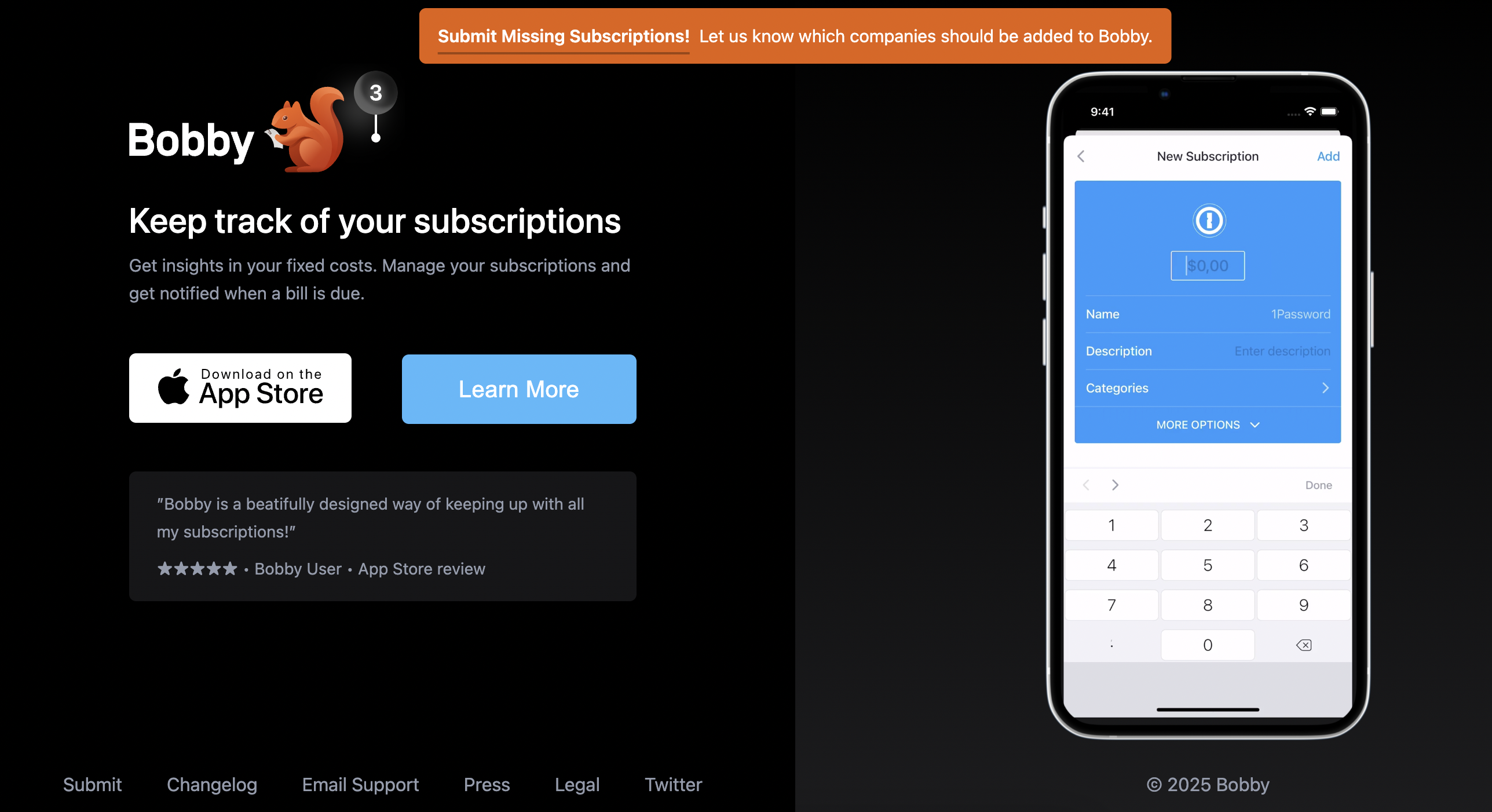

3. Bobby

Bobby takes a simpler approach, functioning primarily as a tracking tool. It doesn’t connect to your bank accounts but instead lets you manually enter subscriptions and their renewal dates.

While this requires more effort up front, some people prefer the control and privacy this method provides.

What Makes a Good Free App to Cancel Subscriptions?

Not all subscription managers work the same way. The best ones share several key features that make them worth downloading.

First, they automatically scan your bank accounts and credit cards to find every recurring charge. No manual entry needed. They pull everything together in one dashboard so you can see exactly what you’re paying for each month.

Second, they categorise expenses clearly. Entertainment subscriptions appear separately from productivity tools or fitness memberships. This organisation helps you spot redundancies quickly—like paying for both Spotify and Apple Music when you only need one.

Third, the strongest options offer built-in cancellation tools. Instead of hunting down customer service numbers or navigating confusing websites, you can cancel directly through the app with a few taps.

What App Helps You Get Rid of Unwanted Subscriptions Most Efficiently?

Speed matters when you’re trying to clean up your finances. The fastest results come from apps that combine automatic detection with one-click cancellation.

PocketGuard and Rocket Money lead this category. Both apps scan your accounts within minutes of connecting them, presenting a complete list of recurring charges almost instantly.

Their cancellation features work directly with service providers, eliminating the back-and-forth that typically drags out for days.

For people with complex financial situations (multiple bank accounts, shared family plans, or business expenses mixed with personal subscriptions), more robust platforms deliver better results.

They can handle the additional complexity without getting confused about which charges matter and which don’t.

Safety Concerns: Is Subscription Stopper a Safe App?

Security concerns naturally arise when apps request access to financial accounts. People wonder whether these tools protect sensitive information adequately or create new vulnerabilities.

Reputable apps for subscription management and cancellation use bank-level encryption to protect user data.

They connect to financial institutions through secure APIs, the same technology your bank’s own app uses. They never store actual banking credentials and can’t move money or make purchases.

Look for apps that clearly explain their security measures. Trustworthy platforms display information about their encryption standards, undergo regular security audits, and carry appropriate insurance to protect users if breaches occur.

Red flags include apps that request unusual permissions, lack clear privacy policies, or have numerous complaints about unauthorised access. Always research user reviews and check ratings before connecting any financial accounts.

Making These Tools Work for You

Downloading an app solves nothing if you don’t use it properly. Here’s how to maximise results:

Connect all relevant accounts: checking, savings, and every credit card you use regularly. Partial connections leave gaps where forgotten subscriptions hide.

Schedule monthly check-ins to review new charges and verify that cancelled services actually stopped billing. Set up alerts for upcoming renewals so you can decide whether to continue or cancel before charges hit.

Most importantly, act on the information these apps provide. Finding subscriptions means nothing if you don’t cancel the ones you’re not using.

Take 15 minutes to review everything, make cancellation decisions immediately, and follow through before moving on to other tasks.

The Bottom Line

Subscription creep affects nearly everyone in our digital economy. But regaining control doesn’t require spreadsheets or hours of research anymore.

The right apps for subscription management and cancellation put financial clarity within reach, often saving people hundreds of dollars with minimal effort.

Whether you choose a free app to cancel subscriptions or invest in premium features, the key lies in taking action. Your forgotten gym membership won’t cancel itself, but with these tools, you can eliminate it in under a minute.

What subscriptions are you still paying for that you’ve forgotten about? Have you tried any subscription management apps, and which features matter most to you?